FEMA Flood Insurance Rate Map Changes

The Federal Emergency Management Agency (FEMA) is in the process of updating the Flood Insurance Rate Maps (FIRM).

In an effort to facilitate public information and understanding, below is a summary on the importance of these maps and how the update may impact you directly.

Purpose of Flood Insurance Rate Maps

Flooding is one of the most common and costly natural disasters. The purpose of the Flood Insurance Rate Maps (FIRM) is to identify the flood vulnerability and risk in communities. They are used by the insurance industry to calculate flood insurance costs and communities across the United States rely heavily on them to guide their decisions about land use and development.

Residents and businesses may also use the maps to better understand their potential flood risk to help identify steps they may need to take to protect against property damage and loss.

Why Are These Maps Being Updated?

The risk for flooding changes over time. Land use, erosion, new building and development, natural forces (like changing weather patterns) and other factors can change how water drains and flows over time.

The current maps in use for Miami-Dade County became effective in 2009. To better reflect current flood risks, the National Flood Insurance Program (NFIP) and FEMA have used the most recent data and latest technology to update these flood insurance rate maps, which are in the preliminary stage and have not yet been adopted.

When will the map changes go into effect?

At this time, the maps are in the preliminary stage and have not yet been adopted. Communities in Miami-Dade County will have a 90-Day Appeal Period for all changes to Special Flood Hazard Areas.

90-Day Appeal Period for Miami-Dade County proposed updated FEMA FIRM: from 12/01/2021 through 3/01/2022.

How Does this Impact my Property?

These new maps may have changed your property's flood zone or base flood elevation (or both), which may impact your flood insurance rate. The changes may require homeowners who don’t currently have flood insurance to obtain coverage. Property owners are encouraged to review the map changes through the resources included below.

Where Can I See if the Map Updates Impacted my Property?

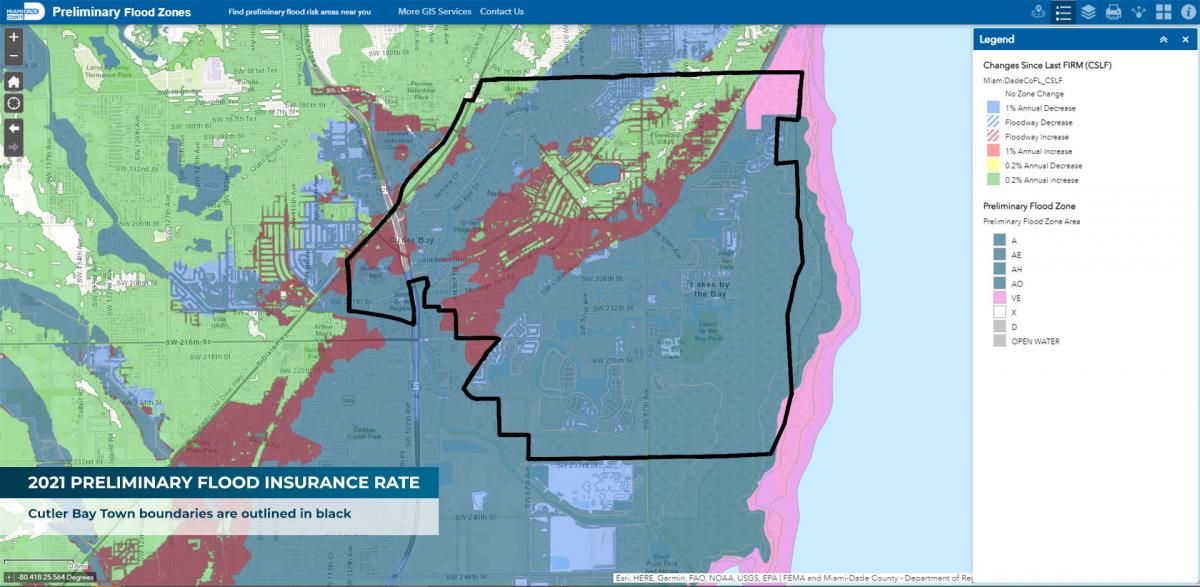

The Miami-Dade Regulatory and Economic Resources Department has developed a flood zone map page that includes a tab to view the preliminary flood zones map changes since the last FIRM update on their interactive web tool. The interactive map allows you to look up your property (by address or folio number) to see if the 2021 Preliminary FIRM has changed the flood zone for your property.

To view the 2009 FIRM visit: http://gisweb.miamidade.gov/floodzone/

In addition, at the bottom of this page, you will find the 2021 Preliminary FEMA Flood Insurance Rate Maps for all of Cutler Bay, divided into panels.

What Should I Do if my Property is Projected to be in a Special Flood Hazard Area?

If the 2021 map now projects your property to be in a Special Flood Hazard Area (SFHA), it is recommended that you buy flood insurance before the maps are adopted, in order to receive the preferred rates.

Being in an X Zone (considered an area of minimal flood hazard) does not guarantee your property will not flood in a future event. It's recommended that properties in the X Zone also purchase flood insurance.

We've included links below that will provide additional information on the topic.

What if There is an Error on the FIRM Changes for my Property?

Members of the community have opportunities to submit evidence on why they believe their property has been improperly mapped. Consider submitting an appeal, comment, and/or Letter of Map Change (LOMC).

Click here for more information on how to submit an LOMC to FEMA’s webpage.

For additional information or questions, contact our Town’s Floodplain Manager, Alfredo Quintero, at (305) 234-4262 or by email at aquintero@cutlerbay-fl.gov.